By, Steve Finkelstein – Senior Partner

Establishing a Finance and Accounting Transition Program

In part one of our series on Finance and Accounting (F&A) transformation we discussed the importance of the strategic role the Finance organization should be playing and how leading Finance organizations are rising to the challenge. In this second part we will discuss use of the Experience on Demand Finance Maturity Model as an initial step in defining a transformation program.

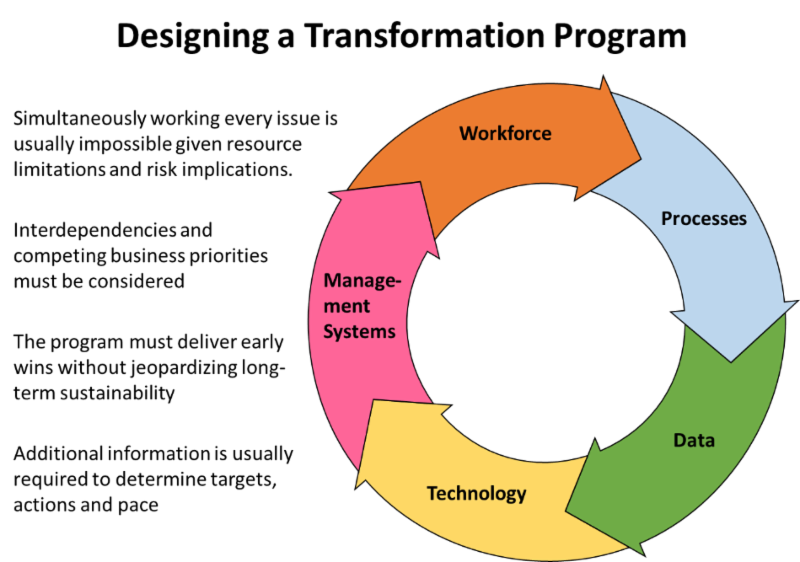

Each finance and accounting transformation program will be somewhat unique depending on objectives, risk tolerance, extent of business support and resource and timeline constraints.

Few organizations try to simultaneously address all their people, process, technology and culture issues because of the potential risk of disruption to core operations such as sales order processing, customer invoicing or financial reporting.

However, there are few process changes that don’t require enabling technology and people change (training, roles, responsibilities and/or organization redesign.) Likewise, most technology changes require process change to achieve the business case and involve some amount of training.

Few finance organizations have internal resources with the right expertise and availability to properly design and effectively guide a complex transformation program. Most organizations are so stretched meeting routine business demands and fighting fires that they haven’t been able to consider how they compare to leading practice and how technology could be leveraged to make life better, much less implement significant change.

So where should you start if you are under pressure to play a more strategic role, reduce cost and improve the speed and quality of business performance analytics, and you are struggling to keep up with the day-to-day? We think the first step is to get a clear understanding of the gaps through a maturity assessment that can be tailored to fit your needs.

FINANCE MATURITY ASSESSMENT

Some companies will jump right in fixing long-term pain points. That may be okay initially, particularly if the objective is to free up resources for a broader transformation program. However, there is significant risk in taking a ready – fire – aim approach to transformation.

Many companies start with quantitative benchmarking to understand how their performance compares to top quartile performers. However, this generally requires a lot of work to collect and scrub the data required for the benchmarking and it may not result in much insight as to how others are achieving better results.

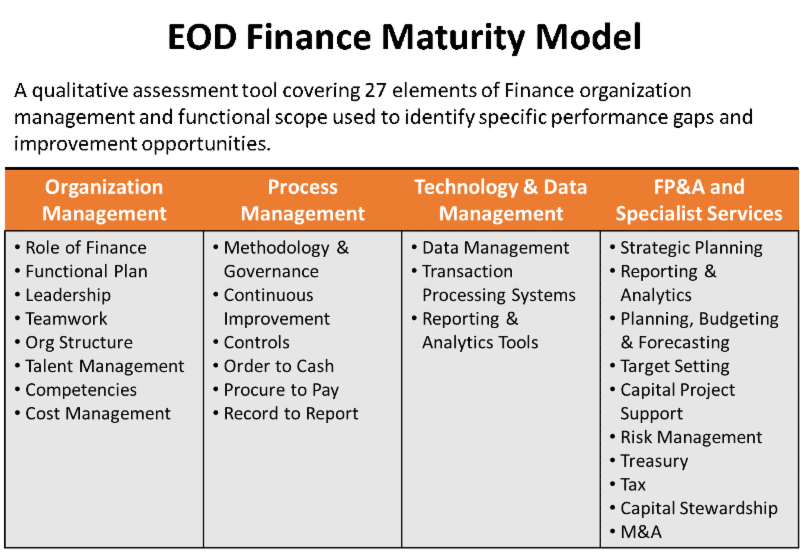

Alternatively, Experience on Demand (EOD) can guide you through a qualitative assessment that leverages the knowledge of the company’s finance staff to assess the as-is and compare that with our extensive understanding of leading practice.

This assessment can incorporate a typical strategic SWOT evaluation (Strengths, Weaknesses, Opportunities and Threats) in addition to the more focused evaluation of the 27 elements shown at right. We typically utilize a combination of online surveys, individual interviews and/or conference room sessions to gather data, depending on the nature of the assessment and the number of people involved.

Coming out of the qualitative assessment we work with the CFO and the finance leadership team to define the strategic business partner role that is most appropriate for their business and, basis that, the target level of maturity/capability for each of the 27 elements. We can then begin to define the people, process, technology and culture changes necessary to close the critical gaps.

However, before working the details of those changes, it is important to formally define the Finance function objectives, case for action and roadmap to guide a successful transformation program. We will discuss that in part three of our series on Finance and Accounting Transformation.

Check our simple Finance Maturity Assessment to see how your organization compares to the leaders.